Focus on Liquidity Instead of Volume when Investing in ETF’s

January 11, 2022

One of the common misconceptions about ETFs is that the daily volume of shares traded is the same as the liquidity of the ETF itself. The reality is, there is very little correlation between the two. Liquidity of an ETF is tied to the liquidity of the underlying securities held in the ETF, not how many shares of the ETF itself trades. Unlike buying an individual stock where daily trading volume is important, an ETF represents an investment in a group of underlying securities, and it is the liquidity of these underlying securities that is important for investors to consider. An ETF is open ended, meaning that when assets come in (or out), shares are added (or sold) to satisfy the inflow/outflow in assets.

Why Should Investors Focus on Liquidity Instead of the Daily Trading Volume of an ETF?

ETFs are comprised of basket of underlying securities and NOT a single stock, although both can actively be bought and sold throughout the day on the same stock exchange. As the investor, you are ultimately receiving a portfolio of underlying securities, through the efficiency of an ETF. For this reason, we believe investors should focus on the liquidity profile of an ETF, rather than the volume, since a more liquid ETF typically creates a tighter price compared to its NAV, resulting in a less movement in the ETF price at the time an investor may be buying or selling.

Here Is How It Works: ETFs and Liquidity

ETF shares are created in specified sizes/lots. For example, a basket of MGMT is 25,000 shares. That basket is made up of the pro-rata shares of stock in each security listed in the basket, which is why we believe the liquidity of those underlying securities matters.

The bid/ask spread of an ETF reflects two things. First, it reflects the overall bid/ask of the underlying securities trading in the market. Second, it reflects any supply/demand of owned ETF shares that are being traded.

Here’s an Example

Let’s assume an ETF trades 5,000 share per day. That volume of the ETF may represent primary shares which are those being bought/sold from/to the market makers. In that case those shares would affect the inventory position of the market maker. It also may represent secondary market buying/selling which are the shares trading from one investor to another. If a new order comes in for 1mm shares, the market makers work with the authorized participants (AP’s) to create the necessary shares to satisfy that demand. Again, in the case of MGMT, the market makers would create 40 new units (1mm shares/25k shares per basket). If the liquidity of the securities held in each basket is sufficient, the overall price of the ETF should see little, if any, impact from these new assets flowing into the fund which often results in a tight or small ETF price compared to the ETF’s Net Asset Value (NAV).

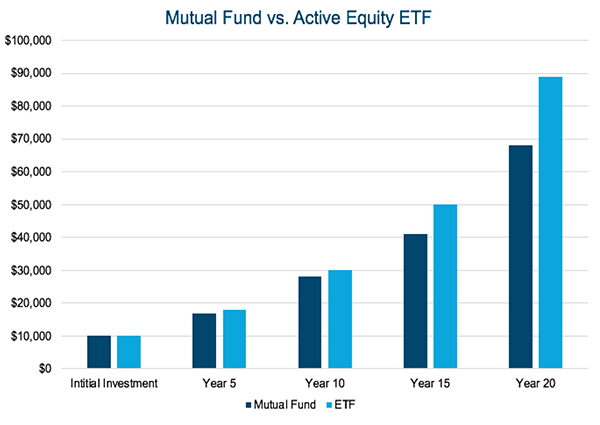

ETFs versus Mutual Funds

When new funds come into/out of a mutual fund, the portfolio manager is alerted and then places trades in the fund to invest those new assets, or sell securities to raise cash to satisfy the outflow. In an ETF, that is all handled by the market makers. The portfolio manager provides the market makers with the make-up of a basket of securities (i.e. the number of shares of each security held in each basket of the ETF). The market maker then works with the AP to deliver/or sell the pro-rata amount of each security held in the basket. That allows the market maker/APs to deliver those securities from trades, or via inventory of those securities already held. For those reasons, the market impact of funds coming into/out of an ETF should be less than a mutual fund, or separately managed account for that matter.

The Bottom Line

The next time you are considering an ETF, focus on the liquidity of the underlying securities, rather than the volume of the ETF, to better understand how the price of the ETF could potentially be impacted when you decide to buy or sell. To read more articles by MGMT on Inflation, click here.

Please visit www.mgmtetf.com for more information on MGMT, an active smallcap and midcap ETF.

Important Notes and Disclosures

Investors should carefully consider the investment objectives, risks, charges, and expenses of the Ballast Small/Mid Cap ETF. This and other important information about the ETF is contained in the Prospectus, which can be obtained at www.mgmtetf.com or by calling (866) 383-6468. The Prospectus should be read carefully before investing. The Ballast Small/Mid Cap ETF is distributed by Northern Lights Distributors, LLC member of FINRA/SIPC Northern Lights Distributors and Ballast Asset Management are not affiliated.

Important Risk Information

ETFs are subject to market fluctuation and the risks of their underlying investments. ETFs are subject to management fees and other expenses. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund.

The Fund (MGMT) is a new ETF and has a limited history of operations for investors to evaluate. The Portfolio Manager has prior experience managing a mutual fund. However, the Adviser has not previously managed a mutual fund or an ETF. As a result, investors do not have a long-term track record of managing an ETF from which to judge the Adviser and the Adviser may not achieve the intended result in managing the Fund. Market risk includes the possibility that the Fund’s investments will decline in value because of a downturn in the stock market, reducing the value of individual companies’ stocks regardless of the success or failure of an individual company’s operations. Securities of companies with small and medium market capitalizations are often more volatile and less liquid than investments in larger companies. Small and mid- cap companies may face a greater risk of business failure, which could increase the volatility of the Fund’s portfolio. The Fund is actively managed and is thus subject to management risk. The Adviser will apply its investment techniques and strategies in making investment decisions for the Fund, but there is no guarantee that its techniques will produce the intended results. The Fund faces numerous market trading risks, including the potential lack of an active market for Fund shares, losses from trading in secondary markets, and periods of high volatility and disruption in the creation/redemption process of the Fund. The net asset value of the Fund will fluctuate based on changes in the value of the U.S. equity securities held by the Fund.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment or tax advice. Please consult with a tax advisor to obtain further information. Graphs, charts, and other similar devices are used in this report. These are inherently limited, difficult to use and cannot be used in and of themselves to determine which securities to buy or sell, or when to buy or sell them. Investors must conduct their own analysis and make their own decisions concerning which securities to buy or sell and when to buy or sell them.

Investors should not assume that their investments will be profitable or that they will experience returns in the future comparable to those set forth herein.

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance. There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses.

This report contains forward‐looking statements within the meaning of the United States federal securities laws. Forward‐looking statements are those that predict or describe future events or trends and that do not relate solely to historical matters. For example, forward‐looking statements may predict future economic performance, describe plans and objectives of management for future operations and make projections of revenue, investment returns or other financial items. A prospective investor can generally identify forward‐ looking statements as statements containing the words “will,” “believe,” “expect,” “anticipate,” “intend,” “contemplate,” “estimate,” “assume” or other similar expressions. Such forward‐looking statements are inherently uncertain, because the matters they describe are subject to known (and unknown) risks, uncertainties, and other unpredictable factors. No representations or warranties are made as to the accuracy of such forward‐looking statements.5695-NLD-11/12/2021