Global Supply Chain Issue, Inventory and What it Means

February 9, 2022

Supply chain issues have been talked about ad nauseam. The Fed points to it as a reason we have inflation today, which is partially/largely true – at least in the near term. What I think is less understood, is that it’s not getting better. Some of that is shipping and logistics. Other bottlenecks are because of the semiconductor shortage. Labor is also an issue in some cases. That means inflation is likely to hang around longer, which means the Fed is likely to be more aggressive, which increases the potential risk they get it wrong and hurt the recovery.

Understanding the inventory situation can be critical to understanding cyclical risk. Why? Because the inventory cycle plays out within a business cycle. Cyclical companies tend to begin a business cycle with low levels of inventory. Suddenly, demand begins to pick up for their products, and they start to produce more. Early on, demand continues to grow faster than they ramp production, and inventory remains low/in balance. Then demand growth slows, but production can remain elevated and inventory builds. Ultimately demand falls, and companies are typically slow to reduce production, which exacerbates the cyclical downturn. That leads to revenue falling more than demand, layoffs, losses, and big “one-time charges” as companies right-size their business.

Given increased uncertainty around global growth, and whether tightening monetary policy (especially in the US) will ultimately destroy demand, understanding the inventory situation and paradox can be important.

Global Supply Chain Issues: Two Examples

Let’s look at two different companies that just reported and lowered revenue growth forecasts for 2022 – both largely due to supply chain issues. The first is F5 (Ticker: FFIV and represents a 2.0% position in MGMT as of 1/28/2022). The second is Lam Research a company we are not invested in (Ticker: LRCX and represents a 0% position in MGMT as of 1/28/2022). Both are selling to fundamentally strong demand – data growth/networking in the case of F5, and growth in the semiconductor fabs (i.e. production) for Lam.

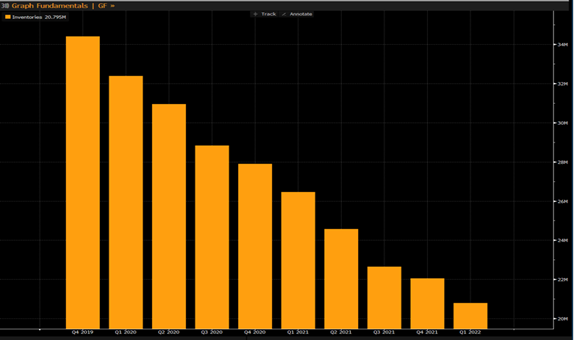

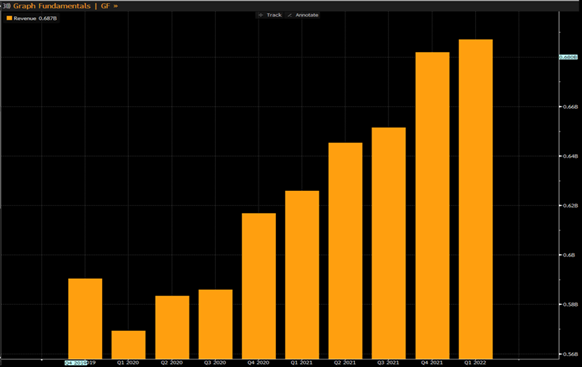

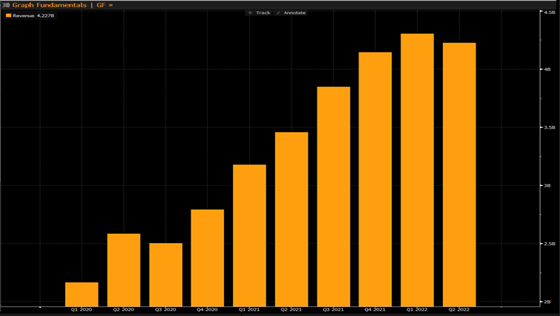

Below is a quarterly look at F5’s inventory, starting from Q4 ’19, right before the pandemic started. The chart that follows is their Revenue during that same period. This is a very abnormal relationship. When companies see sales rise, they start building more product. Almost always. In the case of FFIV, they haven’t done that –due to supply chain constraints. And thus, inventory turnover has doubled.

Source: Bloomberg

Source: Bloomberg

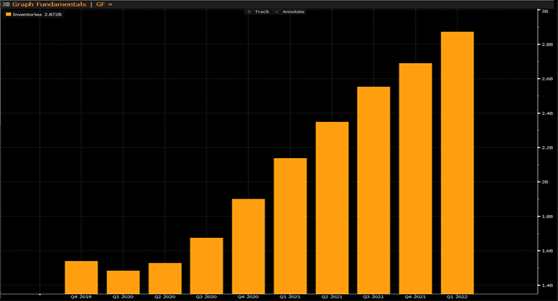

Lam Research (a semiconductor equipment company) that also just reported, and based on supply chain constraints projected for more subdued guidance revenue growth. However, their inventory to revenue relationship is different. Inventory on the left, revenue on the right. This is a more typical relationship. Inventory turnover and Days Inventory Outstanding hasn’t really changed much over the last two years.

Source: Bloomberg

Source: Bloomberg

Both stocks are cyclical and will likely go down when their respective cycles are over. However, we believe the risk associated with F5 (and companies in this inventory position) is much lower. It’s 2 turns cheaper (EBITDA multiple) and both are in a net cash position. Both have pretty good visibility into 2022 demand for their products. The difference we also believe, all else equal, is F5 should have a longer runway, and if the music stops early, less difficulty managing the downturn.

Please visit www.mgmtetf.com for more information on MGMT, an active smallcap and midcap ETF managed by Ballast Asset Management.

Investors should carefully consider the investment objectives, risks, charges, and expenses of the Ballast Small/Mid Cap ETF. This and other important information about the ETF is contained in the Prospectus, which can be obtained at www.mgmtetf.com. or by calling (866) 383-6468. The Prospectus should be read carefully before investing. The Ballast Small/Mid Cap ETF is distributed by Northern Lights Distributors, LLC, member FINRA/SIPC Northern Lights Distributors, LLC, and Ballast Management are not affiliated.

Important Risk Information

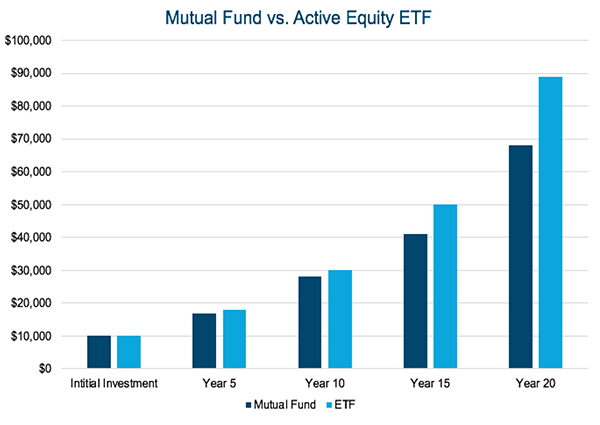

ETFs are subject to market fluctuation and the risks of their underlying investments. ETFs are subject to management fees and other expenses. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund.

The Fund (MGMT) is a new ETF and has a limited history of operations for investors to evaluate. The Portfolio Manager has prior experience managing a mutual fund. However, the Adviser has not previously managed a mutual fund or an ETF. As a result, investors do not have a long-term track record of managing an ETF from which to judge the Adviser and the Adviser may not achieve the intended result in managing the Fund. Market risk includes the possibility that the Fund’s investments will decline in value because of a downturn in the stock market, reducing the value of individual companies’ stocks regardless of the success or failure of an individual company’s operations. Securities of companies with small and medium market capitalizations are often more volatile and less liquid than investments in larger companies. Small and mid- cap companies may face a greater risk of business failure, which could increase the volatility of the Fund’s portfolio. The Fund is actively managed and is thus subject to management risk. The Adviser will apply its investment techniques and strategies in making investment decisions for the Fund, but there is no guarantee that its techniques will produce the intended results. The Fund faces numerous market trading risks, including the potential lack of an active market for Fund shares, losses from trading in secondary markets, and periods of high volatility and disruption in the creation/redemption process of the Fund. The net asset value of the Fund will fluctuate based on changes in the value of the U.S. equity securities held by the Fund.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment or tax advice. Please consult with a tax advisor to obtain further information. Graphs, charts, and other similar devices are used in this report. These are inherently limited, difficult to use and cannot be used in and of themselves to determine which securities to buy or sell, or when to buy or sell them. Investors must conduct their own analysis and make their own decisions concerning which securities to buy or sell and when to buy or sell them.

Investors should not assume that their investments will be profitable or that they will experience returns in the future comparable to those set forth herein.

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance. There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses. 5193-NLD-01312022