Inflation: Unless your Money is Beating it You are Losing It

November 21, 2021

The October Consumer Price Index (CPI) data for October was red-hot and notably greater than what was forecasted by the Federal Reserve. While the concern for higher inflation continues to worry consumers and how it impacts their wallets, it’s also a concern for investors. We want to offer another perspective regarding rising inflation that we believe may be going overlooked and factors that we are paying close attention to as we manage a portfolio of small and midcap stocks.

WHAT WE BELIEVE MAY BE DRIVING INFLATION: PAY ATTENTION TO THESE FACTORS

Increased inflation initially stemmed from low levels of inventory and disruptions in the global supply chain- this has been extensively reported- and in some cases, impacting this most recent quarter of company earnings releases. That was followed by higher energy prices resulting from a dramatic decrease in drilling new wells and the natural decline in production from existing wells. So where do we go from here?

While global supply chains will eventually get sorted out, and higher commodity prices should prompt more drilling (the US rig count has nearly doubled in the last year, albeit still ~50% lower than 2019 levels), we believe there is an underlying cause of persistent inflation: Sustainability. We believe the global shift to greater sustainability and lower carbon emissions is inflationary.

According to Bloomberg, assets managed under ESG standards will total ~$38 trillion by the end of this year. That is expected to climb to $53 trillion by 2025. By definition, those assets generally avoid companies with significant exposure to carbon – especially fossil fuels. The Sustainable Finance Disclosure Regulation (SFDR) in Europe, which is aimed at ESG funds that are “greenwashing” their investments – using crafty reasoning/marketing to make people believe that a company is doing more to protect the environment than it really is – will likely further erode the aggregate amount of capital available for investment in traditional energy production. That means the cost of capital in traditional energy production will remain high and will likely continue to go up.

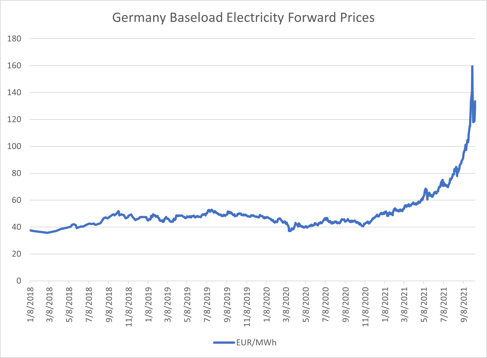

We believe this higher cost of capital, along with a more recent trend of investors requiring E&Ps to generate free cash flow (as opposed to just showing production growth and earnings), will stymie production growth of fossil fuels. In fact, that is the point of the sustainability initiative. The reason that will likely be inflationary is because global movement of capital away from fossil fuels into ESG is occurring faster than the build-out of alternative energy sources. As an example, in 2011 Germany got about 25% of its power from nuclear energy. By next year, Germany plans to have shut down ALL of that nuclear capacity, which will eliminate about 11 gigawatts of electricity production, on top of the 10 gigawatts already scuttled over the last decade. The pace of the transition is largely responsible for the spike in electricity prices in Germany and throughout Europe.

To be clear, we are not arguing this shift to sustainability is the wrong thing to do, only that the mismatch between capacity coming offline from traditional sources of energy versus capacity coming online of new, renewable sources of energy is causing a spike in energy prices that we believe will persist in the medium term.

The transition to electric vehicles further exacerbates the problem because it increases demand for electricity. All the while, we believe the cost of gasoline will remain elevated due to the aforementioned headwinds facing E&Ps. That puts consumers in quite a pickle.

That phenomenon is also why we are concerned inflation will be less transitory than the Fed keeps professing – or at least that this represents a reset in prices rather than a short-term spike. Traditionally, economists view inflation “ex food and energy.” Ignoring the irony in the fact that we actually need those things to live, this calculation was reasonable in the past because those prices tended to be volatile and would revert after some short period of time. While we may see the price of gasoline spike for a year or so, increased production solved the problem in fairly short order. We are concerned that will not be the case this time around. Often producers choose (or are forced) to eat the higher costs in the near term. The longer higher energy prices persist, the more likely we will see those higher costs make it into the products that require that energy – like almost everything.

The other tailwind to inflation from the sustainability shift stems from the cost of this new capacity. Those nuclear power plants, once shut down, are worthless. Actually, they are less than worthless because they have ongoing liabilities associated with them. Conversely, the new sources of energy to offset that nuclear production and growth with increasing demand comes at a significant cost. Even with massive help from governments, there will likely be some sort of demand for a return on the money spent to build that capacity. In fairness, the operating costs of solar/wind production is much lower than coal, gas or nuclear energy and this will eventually sort itself out – but we think we could be decades away from that. We cannot say what the Fed’s definition of “transitory” is, but years/decades feels more to us like actual inflation.

A Response To Inflation: Two Viable Investment Solutions

We will not wade into the solution for the sustainability shift paradox. From an investment perspective, we believe the two most viable solutions is to invest in: 1) Levered Real Assets and 2) Companies with pricing power.

While we are not calling for this type of hyper-inflation, during the Weimar Republic between 1921 and 1923, which witnessed rampant inflation, one of the single best performing assets was leveraged real estate. The reason is simple – the “value” of the debt on the real estate fell dramatically, while the value of the underlying asset increased with the inflation.

The second way to potentially mitigate the risk from inflation is a bit more difficult. Identifying companies with the pricing power to thwart elevated inflation requires fundamental analysis of competitive position, necessity of the product, substitutions available, etc. For example, a grocery store effectively has no pricing power – while we certainly need their products, their competitive position is terrible and there are ample substitutions available within their product set. In contrast, consolidated industries supplying necessary products with limited substitution risk are more protected – like a software company.

Further, we would avoid fixed income – especially bonds with fixed interest rates. Here you get the double whammy of the value of the principal diminishing because of inflation, and the price of the bond itself falling as a result of rising interest rates that will surely occur in conjunction with the elevated inflation.

Important Notes and Disclosures

Investors should carefully consider the investment objectives, risks, charges, and expenses of the Ballast Small/Mid Cap ETF. This and other important information about the ETF is contained in the Prospectus, which can be obtained at www.mgmtetf.com or by calling (866) 383-6468. The Prospectus should be read carefully before investing. The Ballast Small/Mid Cap ETF is distributed by Northern Lights Distributors, LLC member of FINRA/SIPC Northern Lights Distributors and Ballast Asset Management are not affiliated.

Important Risk Information

ETFs are subject to market fluctuation and the risks of their underlying investments. ETFs are subject to management fees and other expenses. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund.

The Fund (MGMT) is a new ETF and has a limited history of operations for investors to evaluate. The Portfolio Manager has prior experience managing a mutual fund. However, the Adviser has not previously managed a mutual fund or an ETF. As a result, investors do not have a long-term track record of managing an ETF from which to judge the Adviser and the Adviser may not achieve the intended result in managing the Fund. Market risk includes the possibility that the Fund’s investments will decline in value because of a downturn in the stock market, reducing the value of individual companies’ stocks regardless of the success or failure of an individual company’s operations. Securities of companies with small and medium market capitalizations are often more volatile and less liquid than investments in larger companies. Small and mid- cap companies may face a greater risk of business failure, which could increase the volatility of the Fund’s portfolio. The Fund is actively managed and is thus subject to management risk. The Adviser will apply its investment techniques and strategies in making investment decisions for the Fund, but there is no guarantee that its techniques will produce the intended results. The Fund faces numerous market trading risks, including the potential lack of an active market for Fund shares, losses from trading in secondary markets, and periods of high volatility and disruption in the creation/redemption process of the Fund. The net asset value of the Fund will fluctuate based on changes in the value of the U.S. equity securities held by the Fund.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment or tax advice. Please consult with a tax advisor to obtain further information. Graphs, charts, and other similar devices are used in this report. These are inherently limited, difficult to use and cannot be used in and of themselves to determine which securities to buy or sell, or when to buy or sell them. Investors must conduct their own analysis and make their own decisions concerning which securities to buy or sell and when to buy or sell them.

Investors should not assume that their investments will be profitable or that they will experience returns in the future comparable to those set forth herein.

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance. There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses.

This report contains forward‐looking statements within the meaning of the United States federal securities laws. Forward‐looking statements are those that predict or describe future events or trends and that do not relate solely to historical matters. For example, forward‐looking statements may predict future economic performance, describe plans and objectives of management for future operations and make projections of revenue, investment returns or other financial items. A prospective investor can generally identify forward‐ looking statements as statements containing the words “will,” “believe,” “expect,” “anticipate,” “intend,” “contemplate,” “estimate,” “assume” or other similar expressions. Such forward‐looking statements are inherently uncertain, because the matters they describe are subject to known (and unknown) risks, uncertainties, and other unpredictable factors. No representations or warranties are made as to the accuracy of such forward‐looking statements.5695-NLD-11/12/2021