A Primer on Possible ETF Tax Benefits

June 25, 2021

ETFs have potential tax advantages over mutual funds. ETF vehicles allow for the capital gains taxes incurred by the investors to be deferred until the sale of the ETF. Conversely, mutual funds pass on capital gains to investors each year over the life of the investment, which can lead to lower compounded returns versus the same strategy in an ETF.

Key Observations

- Higher Taxes for 2022 and beyond are likely on the horizon.

- ETFs can be a useful tool to help investors manage taxes effectively.

- ETFs tend to be more tax efficient than mutual funds or separately managed accounts given their ability to transact on an “in-kind” basis rather than cash.

- ETFs can provide investors exposure to potentially growing asset classes that offer favorable tax treatments.

We expect higher tax rates in 2022 and beyond. ETF’s may be attractive while long-term capital gains tax rates are still at 15% for many investors.

With taxes expected to increase under the current administration, we believe tax efficient vehicles are becoming more attractive. According to multiple news sources, the Biden Administration is in the midst of drafting a new tax plan to increase taxes in order to fund its key initiatives. These tax increases are likely to focus on capital gains and individual tax rates, in addition to higher corporate tax rates. We believe now is the time to take advantage of lower rates on capital gains by investing in tax efficient ETFs.

ETFs work differently that Separately Managed Accounts and Mutual Funds. Active ETFs can, if managed correctly, avoid realizing capital gains, allowing taxable accounts to defer capital gains taxes nearly indefinitely. The details can be considered complex but effectively, ETFs allow managers to swap stocks without realizing a taxable gain on the security you are getting rid of.

Here's how it works.

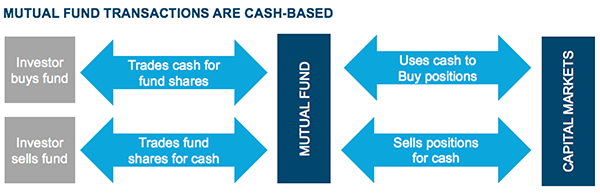

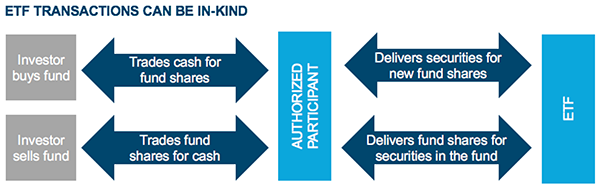

ETFs operate under different regulations and laws than Mutual Funds and SMAs. The bottom line is that active ETFs managers can use “in-kind” transfers to make portfolio changes, avoiding cash transactions to buy and sell securities that result in capital gains and losses to the fund.

Source: GlobalXETFS.com

Effectively managed active ETFs are taxed more like IRAs, as most of the taxable gains are incurred when an investor sells the ETF. Additionally, the capital gain is the difference between what they paid for the share and not what they received for the share upon selling (like a stock). In contrast, mutual fund investors pay capital gains tax on the Fund’s basis, which may have been established long ago and have nothing to do with the investor’s realized performance.

As a simple example, if a portfolio manager decides to sell Coke, and buy Pepsi in a mutual fund (or SMA), there are two transactions. First, the sale of Coke, then buying of Pepsi. In this transaction, the client is taxed on any gains in Coke, and has a new cost basis in the purchase of Pepsi.

With an ETF, using the same example, we can effectively swap Coke for Pepsi without an actual cash transaction, therefore eliminating the requirement of having a taxable gain to distribute to investors. As a result, we can continue to compound returns on future investments (in this case Pepsi) at the full amount “sold” from Coke, rather than the net amount left after paying taxes.

Historically, this may not have been as big of a deal for clients because long-term capital gains taxes were 15%. However, if that rate moves up to 25%, or 35%, the benefits could become more material. Said differently, an ETF acts more like a traditional retirement fund with investments tax-deferred until the investor chooses to receive the proceeds.

Doesn’t Sound Like Much?

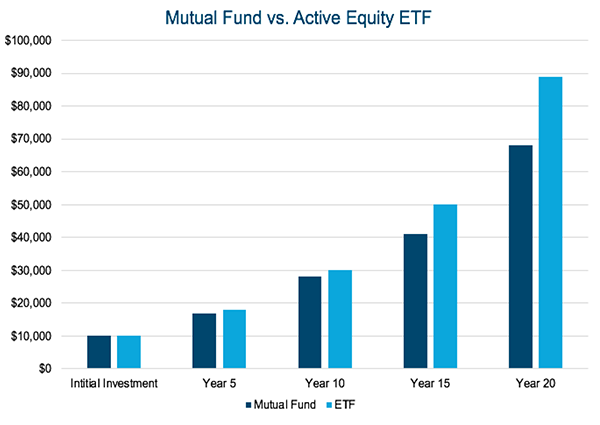

Below is an illustration showing what 1.5% annual benefit means over a 10-year period, assuming 11.5% annual gains on the ETF and 10% on the same strategy in a mutual fund. Notably, after 10- years, that same $10,000 investment outperforms by over $3,700, or 37% of the initial investment. After 20 years, the difference is more than $20,000, or 2x the initial investment.

This is a hypothetical illustration and is not intended to reflect the actual performance of any particular

security. Future performance cannot be guaranteed and invest yields fluctuate with market conditions.

Source: Ballast Asset Management

Important Risk Information

Investors should carefully consider the investment objectives, risks, charges, and expenses of the Ballast Small/Mid Cap ETF. This and other important information about the ETF is contained in the Prospectus, which can be obtained at www.mgmtetf.com. or by calling (866) 383-6468. The Prospectus should be read carefully before investing. The Ballast Small/Mid Cap ETF is distributed by Northern Lights Distributors, LLC, member FINRA/SIPC Northern Lights Distributors, LLC, Skypoint Capital Partners, LLC and Ballast Management are not affiliated.ETFs are subject to market fluctuation and the risks of their underlying investments. ETFs are subject to management fees and other expenses. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund.

The Fund (MGMT) is a new ETF and has a limited history of operations for investors to evaluate. The Portfolio Manager has prior experience managing a mutual fund. However, the Adviser has not previously managed a mutual fund or an ETF. As a result, investors do not have a long-term track record of managing an ETF from which to judge the Adviser and the Adviser may not achieve the intended result in managing the Fund. Market risk includes the possibility that the Fund’s investments will decline in value because of a downturn in the stock market, reducing the value of individual companies’ stocks regardless of the success or failure of an individual company’s operations. Securities of companies with small and medium market capitalizations are often more volatile and less liquid than investments in larger companies. Small and mid- cap companies may face a greater risk of business failure, which could increase the volatility of the Fund’s portfolio. The Fund is actively-managed and is thus subject to management risk. The Adviser will apply its investment techniques and strategies in making investment decisions for the Fund, but there is no guarantee that its techniques will produce the intended results. The Fund faces numerous market trading risks, including the potential lack of an active market for Fund shares, losses from trading in secondary markets, and periods of high volatility and disruption in the creation/redemption process of the Fund. The net asset value of the Fund will fluctuate based on changes in the value of the U.S. equity securities held by the Fund.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment or tax advice. Please consult with a tax advisor to obtain further information. Graphs, charts, and other similar devices are used in this report. These are inherently limited, difficult to use and cannot be used in and of themselves to determine which securities to buy or sell, or when to buy or sell them. Investors must conduct their own analysis and make their own decisions concerning which securities to buy or sell and when to buy or sell them.

Investors should not assume that their investments will be profitable or that they will experience returns in the future comparable to those set forth herein.

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance. There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses.

This report contains forward‐looking statements within the meaning of the United States federal securities laws. Forward‐looking statements are those that predict or describe future events or trends and that do not relate solely to historical matters. For example, forward‐looking statements may predict future economic performance, describe plans and objectives of management for future operations and make projections of revenue, investment returns or other financial items. A prospective investor can generally identify forward‐ looking statements as statements containing the words “will,” “believe,” “expect,” “anticipate,” “intend,” “contemplate,” “estimate,” “assume” or other similar expressions. Such forward‐looking statements are inherently uncertain, because the matters they describe are subject to known (and unknown) risks, uncertainties, and other unpredictable factors. No representations or warranties are made as to the accuracy of such forward‐looking statements. 2284-NLD-4/13/2021

Skypoint Capital Partners, LLC serves as a wholesale marketing agent for Ballast Asset Management.