Volatility Gremlins

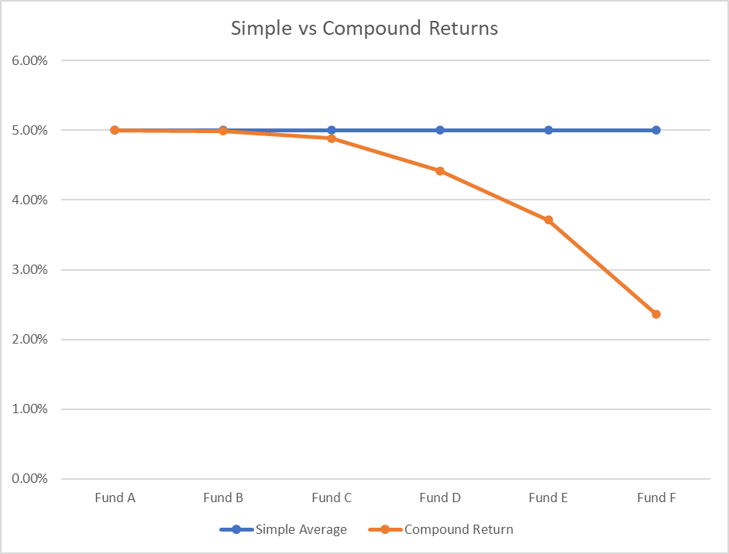

Ed Easterling of Crestmont Research coined this phrase a couple decades ago, describing how volatility impacts the growth of investment portfolios. The concept simply describes the important difference between average returns versus compound returns. Stated plainly, portfolios can have the exact same average return over a period of time, but vastly different compound returns, due to volatility – specifically periods of losses. See the simple example below, where 5 investments have the exact same average return over a period of 3 years, but with very different volatility of returns.

| Fund A | Fund B | Fund C | Fund D | Fund E | Fund F | |

| Year 1 | 5% | 4% | 11% | 15% | 25% | 30% |

| Year 2 | 5% | 4% | 5% | -10% | -15% | -25% |

| Year 3 | 5% | 7% | -1% | 10% | 5% | 10% |

| Simple Average | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% |

| Compound Return | 5.0% | 5.0% | 4.9% | 4.4% | 3.7% | 2.4% |

This phenomenon is exactly why we define risk in two terms:

- A permanent loss of capital

- Downside Volatility

Over time, compound returns are influenced by not just how well you did with your successful investments, but also how poorly you did in your bad investments. It feels great to knock the cover off the ball with a winner, but to generate true outperformance one also needs to avoid stepping in big holes. That is why we employ a strict discipline around downside analysis – determining what we think the worst-case scenario is for each individual stock we purchase, and limiting that downside to 30% or less.

This is also why we manage a portfolio of 40-60 stocks. Academic research shows that most managers’ Alpha is tied directly to only a handful of their investments. Therefore, why not just invest in those ideas with the greatest potential, for which you have the most conviction in the outcome, and eliminate the dilutive effects of all the other investments? The answer is multiple. First, relying on “conviction” exposes the investor to a multitude of behavioral pitfalls in their decision making (e.g., Overconfidence Bias, Loss Aversion, Endowment Effect, Availability Heuristic, etc.). Second, the academic research requires that one know ex ante (beforehand) which investments would perform best and that they actually picked only those handful of big winners without the benefit of hindsight. Third, it assumes one would be willing to own the same risk at a very large position sizes (e.g., 10-15% positions versus 1-3%).

In order to offset these potential biases, we combine an asymmetric upside/downside framework with reasonable diversification in holdings so that we can limit downside volatility, while allowing the compounding effect to take over. The Process relies on being consistent in seeking to lower losses when we are wrong relative to generating outsized gains when we are right.

As active investors, we believe we are exploiting information inefficiency within the market. Stated plainly, we believe that through fundamental analysis, we can use all publicly available information to make an informed decision that is not readily apparent to the market as a whole. As a result, we are almost certain to be wrong from time to time, both due to errors of omission and commission. With that admission at the forefront, we rely on a manufacturing process that stresses analytical rigor that can be measured and tested, rather than the emotional aspects of decision making.

Important Notes and Disclosures

Information presented herein is intended solely for educational purposes. Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment or tax advice. It is strongly suggested that the reader seek their own independent advice in relation to any investment, financial, legal, tax, accounting or regulatory issues discussed herein. The information contained herein is current as of the date indicated on the cover of this document and is believed to be reliable and/or has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of the information and opinions.

This presentation contains “forward-looking statements” which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "target", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof or other variations thereon or comparable terminology. Because such forward-looking statements involve risks and uncertainties, actual results of Ballast Asset Management (“Ballast”) may differ materially from any expectations, projections, market outlooks, estimates or predictions (collectively, “Predictions”) made or implicated in such forward-looking statements, and all Predictions contained herein are subject to certain assumptions. Other events which were unforeseen or otherwise not taken into account may occur; these events may significantly affect the returns or performance of any investment strategy. Any Predictions should not be construed to be indicative of the actual events which will occur. Prospective investors are therefore cautioned not to place undue reliance on such forward-looking statements. In addition, prospective investors should bear in mind that past results are not necessarily indicative of future results, and there can be no assurance that Ballast will achieve results comparable to those of any prior or existing fund or product managed by Ballast or its management team. For disclosures related to Ballast social media, please refer to https://ballastam.com/wp-content/uploads/2023/02/Ballast-Social-Media-Disclosure.pdf

![]()