The Next Problem for Banks

Stating the obvious, banks have a problem. Perhaps less obvious, we think the market is focused on the less material risk. Banks failing is clearly a bad sign for the economy. What concerns us most is what we believe is likely to come next.

First off, we have not seen banks with issues on the Liability (Deposits) side of the ledger for over 100 years (i.e. the Great Depression). In summary, that is what the most recent failed/failing banks (SVB, First Republic, PacWest) are dealing with. To be clear, we think the government (Fed, FDIC, FHLB) will ultimately, and necessarily step in to protect deposits. HOWEVER, that is just problem number #1.

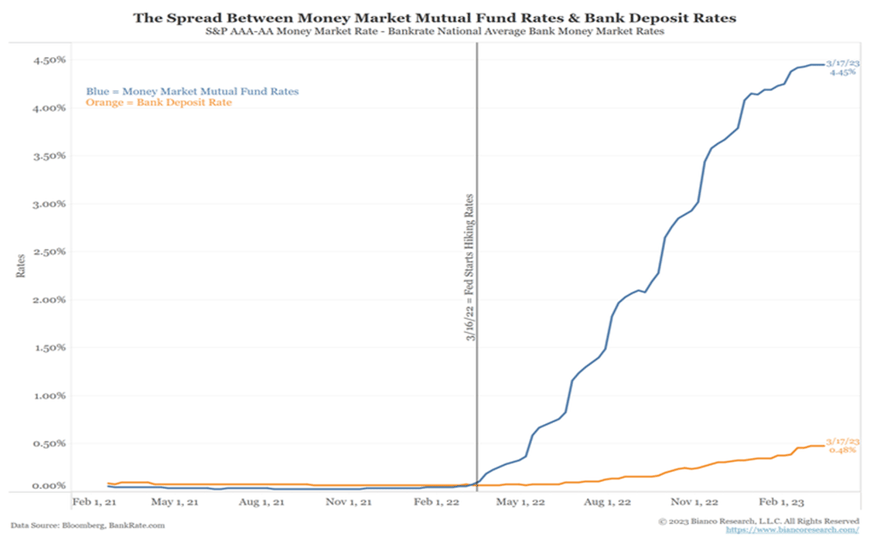

Problem #2 – we believe this event will prompt folks to look at their own checking/savings accounts, and then realize that the interest rate they are being paid on their deposits is way too low. The vast majority of banks are paying 1% or less at the moment – with a 5% Fed Funds rate. We believe that to stave off more deposits leaving, those banks will need to raise those interest rates, which dramatically reduces their profitability (Net Interest Margin).

Problem #3 – this is all happening as demand for loans is falling (higher rates, rising credit standards and more uncertainty), so those same banks are going to have a very difficult time offsetting rising deposit costs with higher rates on new loans issued.

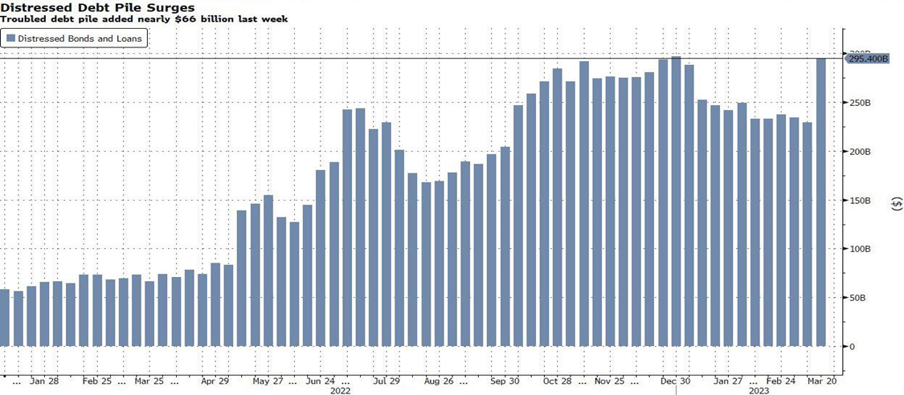

Problem #4 - we haven’t even gotten to the Asset (Loans) side of the balance sheet yet, which is what causes most banks to fail (e.g. the Great Financial Crisis). If we are in a recession, or heading for a recession, we will almost certainly see a rise in defaults on loans, which banks will need to recognize as losses and/or increase their reserves for future losses.

Source: Zero Hedge, Bloomberg

Problem #5 – we do not believe there is any political appetite to save the equity/bond holders of banks. Just like with SVB and Credit Suisse, the depositors are fine, the loans still exist, and the investment securities can simply be held to maturity, but the equity and bond holders were wiped out.

“Shareholders and debtholders of the failed banks are not being protected by the government.”

- Janet Yellen, March 22, 2023

The SVB/First Republic situations are not our primary concern. We are focused on Problems 2-5. With the liquidity provided by the Fed, FHLB and FDIC, banks will likely be able to access the loans they need to back-fill any lost deposits, albeit at dramatically higher interest costs than they were paying on deposits. The culmination of rising deposit costs, lower loan growth, increased losses on loans and with higher reserves for future losses worries us most.

Important Notes and Disclosures

Information presented herein is intended solely for educational purposes. Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment or tax advice. It is strongly suggested that the reader seek their own independent advice in relation to any investment, financial, legal, tax, accounting or regulatory issues discussed herein. The information contained herein is current as of the date indicated on the cover of this document and is believed to be reliable and/or has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of the information and opinions.

This presentation contains “forward-looking statements” which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "target", "project", "estimate", "intend", "continue" or "believe" or the negatives thereof or other variations thereon or comparable terminology. Because such forward-looking statements involve risks and uncertainties, actual results of Ballast Asset Management (“Ballast”) may differ materially from any expectations, projections, market outlooks, estimates or predictions (collectively, “Predictions”) made or implicated in such forward-looking statements, and all Predictions contained herein are subject to certain assumptions. Other events which were unforeseen or otherwise not taken into account may occur; these events may significantly affect the returns or performance of any investment strategy. Any Predictions should not be construed to be indicative of the actual events which will occur. Prospective investors are therefore cautioned not to place undue reliance on such forward-looking statements. In addition, prospective investors should bear in mind that past results are not necessarily indicative of future results, and there can be no assurance that Ballast will achieve results comparable to those of any prior or existing fund or product managed by Ballast or its management team. For disclosures related to Ballast social media, please refer to https://ballastam.com/wp-content/uploads/2023/02/Ballast-Social-Media-Disclosure.pdf